If you only want one card in your wallet, consider the Hilton Aspire from American Express.

If you only want one card in your wallet, consider the Hilton Aspire from American Express.

When American Express announced that they were going to release a co-branded luxury hotel credit card with Hilton, I was less than thrilled. I am a Starwood loyalist, and haven’t stayed at many Hilton properties other than Hampton Inn, so I didn’t really know what they have to offer. However, when I read about the card, I realized it was a complete no-brainer to get, and effectively pays you to hold it every year, regardless of whether or not you use all of its benefits.

Here is a quick snapshot of what you get for your $450 annual fee:

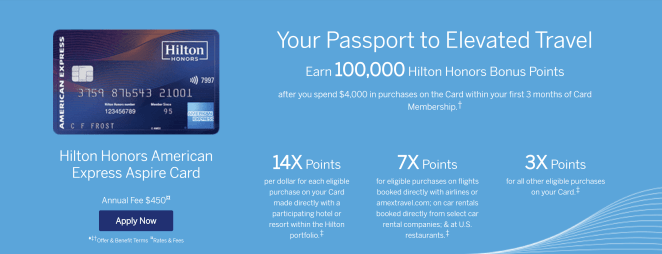

- 100,000 Hilton points when you spend $4,000 within 3 months of account opening (one-time bonus)

- $250 per year incidental airline fee credit (calendar year)

- $250 per year Hilton resort credit (cardmember year)

- Free Weekend Night (cardmember year)

- Free Hilton Honors Diamond Status

- $100 property credit on certain stays

- Priority Pass Select membership (you + 2 guests)

The Aspire Card also has an extremely favorable earning Hilton points earning rate:

- 14 points per dollar on Hilton stays

- 7 points per dollar on (US) restaurants, flights, and rental cars

- 3 points per dollar everywhere else

I value Hilton points at roughly 0.5 cents per point, so you earn a whopping 7% on Hilton stays (you will also earn an additional 20 points per dollar during stays due to your Diamond status, so a 17% overall return), 3.5% on dining, flights, and rental cars, and 1.5% on every purchase.

Maximizing your benefits

Taking advantage of your card benefits couldn’t be easier. The $250 airline incidental fee credit prohibits purchasing gift cards, but you are still able to do so with certain airlines (Delta and Southwest). I will be happy to tell you how, just chat or email me as it is a loophole that isn’t widely publicized to help keep it from being fixed.

The $250 Hilton resort credit is a little more tricky, as it can only be used at certain properties, which you can view at www.hilton.com/resorts. There are several Disney-area properties in Orlando, beachfront properties in Hawaii, and 2 hotels in Vegas which are eligible for the credit. And, as long as you use your Aspire credit card to guarantee your incidentals, you can use the credit on Hilton points stays! I booked a stay at the Tropicana Las Vegas for 18,000 Hilton points in December, and will have my whole $250 credit to enjoy while I am there.

After maximizing just these two perks, you are already at a $50 net credit without spending a dollar on the card (after credits are applied), so every other perk is just gravy. The Free Weekend Night certificate can easily be worth $300 if used at a nicer property, like the Roosevelt, a Waldorf Astoria hotel, in New Orleans (where I am using mine). The Hilton Diamond status allows you to have free breakfast at almost any property, and even offers complimentary suite upgrades based on availability. The Priority Pass Select membership allows you to relax and grab a drink before you enjoy your next flight courtesy of your airline gift card incidental fee credit. And the $100 credit on certain stays can get you a nice dinner, although it only applies at more expensive properties so you may not use it.

All in all, you can easily get $800 in value each year that you hold the card, which more than justifies the annual fee. Add in the insane earn rate on Hilton stays, and you have a contender for the best card in your wallet (I’m looking at you, Chase Sapphire Reserve). If you think the Hilton Aspire Card is a good fit for your wallet, you can apply here!