Credit Card Points aren’t just for flights and hotels: you can even book a cruise!

For as much as I travel, I have never actually been on a cruise. Fortunately, due to an ongoing offer from Virgin Red, I was able to book an 8 Night Eastern Caribbean Virgin Voyages cruise for 100,000 Virgin Points and ZERO Cash. 100,000 points may sound like a lot, but you can easily earn them in a few months by meeting a sign up offer from American Express or Chase, both of whom transfer to Virgin Atlantic/Virgin Red.

What makes this offer truly special is that it requires ZERO cash. No port fees, no taxes, no gratuities, no crazy WiFi charges, AND you can bring a travel partner for free. Plus, the redemption already includes a Sea Terrace (aka balcony) room so you will be cruising in style!

Virgin Voyages is making waves in the cruise industry. Their ships are smaller than Carnival and Royal Caribbean, and they are adults-only which is a huge plus for me. They don’t do drink packages, and opt for a simpler model of making quality beverages affordable.

I have been meaning to sail with them since their launch, but Covid has always gotten in the way. Thanks to American Express’ extremely generous sign up bonus on the Platinum Card, I had more than enough points to book this cruise. In fact, they even had a 30% transfer bonus to Virgin Atlantic (sadly this has ended for now) so I actually only had to redeem 77,000 Membership Rewards points for this redemption, which is just over half of the whopping 150,000 Membership Rewards Points you will earn by applying with my referral link and spending $6,000 within 6 months of being approved.

While American Express is by-far my favorite rewards program and card issuer, you can also get a solid 60,000 point sign up bonus for spending $4,000 in the first 3 months via the Chase Sapphire Preferred Card, which offers more flexible earning categories than the Amex Platinum with a comparatively minimal $95 annual fee. These do come at a cost, as the Platinum Card offers a host of benefits ranging from monthly streaming credits, cell phone insurance, and travel delay/cancellation benefits, plus access to Centurion Lounges, Delta Skyclubs (when flying Delta), and Priority Pass lounges.

Whichever card you end up with, you will be well on your way to redeeming your rewards for dream vacations using points earned from money you were going to spend on bills anyways. That is the beauty of my credit card strategy, I spend organically and still get to travel in style on the card issuer’s dime which is a win in my book!

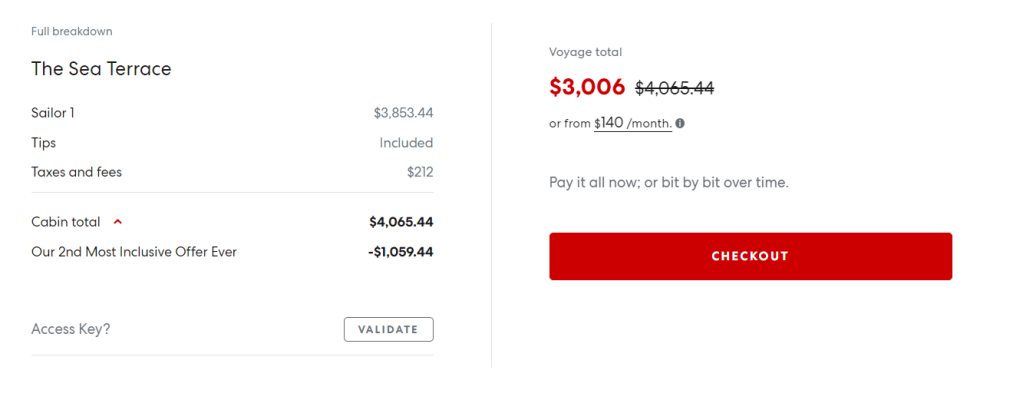

The cruise I booked is now sold out, but there are plenty of options still available for redemption. And for reference, a shorter cruise in my same room is currently retailing for $4,100, which is proof of the incredible value of this redemption.

I’ll be posting about my onboard experience once I set sail on April 8th, but I would love to answer any questions you have about credit card rewards, my overall strategy, and the best card for you. I will happily provide any advice for free, and only ask that you use my referral links if you choose to go with a card from American Express or Chase.

IMPORTANT NOTE: when you apply for and are approved for cards using my referral links, the card issuer gives me some bonus points for referring you. Generally, my referral links are better offers than those that are publicly available, but if they aren’t, I will always point you to both options so you can decide which is best for you.