Finding First Class Award Availability on Japan Airlines is difficult. Finding it for only 80,000 AAdvantage Miles is nearly impossible.

I want to preface this by saying that this is not a deal you will come by often, but is all the more reason to have credit cards issued by multiple banks as each have their own transfer partner network. I have cards from all major issuers except Capital One, and I couldn’t have booked this trip without having a stockpile of American Airlines AAdvantage miles and Alaska Airlines MileagePlan Miles.

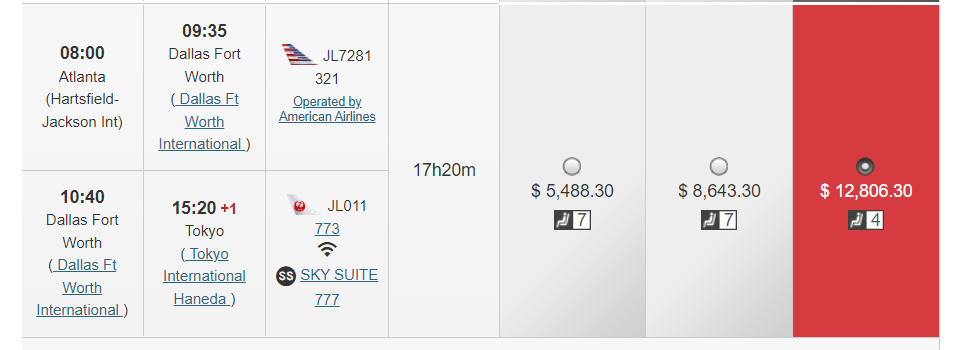

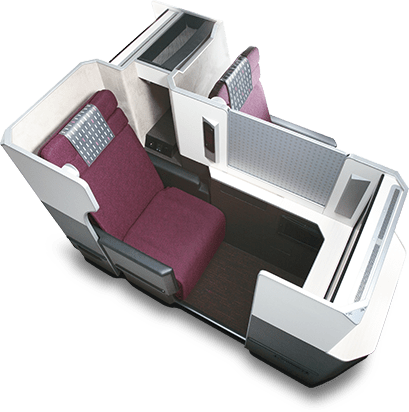

I was fortunate to hear about widespread Japan Airlines (JAL) Business Class award availability in January 2024 which can be booked via AAdvantage Miles (60,000) or MileagePlan Miles (60,000). I consider AA miles to be far less valuable than Alaska miles, so I checked the AA app first. I found plenty of availability out of Atlanta with stops in Dallas DFW or Chicago ORD, but one fare in particular caught my eye. A single flight pair from ATL -> DFW -> HND (the closer of the two Tokyo airports) showed a warning that my desired class of service (Business) wasn’t available on all segments, but was priced at 80,000 AAdvantage miles vs. the 60,000 miles I was expecting. I decided to drill in and found that it was the AA flight from ATL to DFW which was in economy (😭) BUT the flight from DFW to HND was operated by Japan Airlines and was a First Class fare! I knew that this was extremely rare, so I booked the flight before checking if I had a way to get home, or a hotel in Tokyo!

Once I had booked the flight, I decided to see just how much cash this exact ticket was selling for. I knew it wouldn’t be cheap, considering I redeemed roughly $1,120 worth of AAdvantage miles to grab the seat and Japan Airlines is known for 5 Star Service, but I wasn’t expecting it to cost a whopping $12,806.30 had I paid cash for it! That is an astounding 16 cents per point redemption which is almost unheard of.

Finding my way home proved to be a bit more challenging than I expected, but I managed to snag a Nonstop Business Class award ticket on Japan Airlines from Tokyo HND to San Francisco SFO by redeeming 60,000 Alaska Airlines MileagePlan miles. I probably could have found a routing using more miles in another program which would have allowed me to travel on to Atlanta, but I figured I would grab a quick flight to Vegas since I was going to be nearby anyways. This redemption was also bookable via the same amount of AAdvantage miles, but I had burned my stockpile on the first leg of the trip. Fortunately, I have a massive stockpile of Alaska miles due to their longstanding transfer relationship with Marriott (3 Marriott Points -> 1 Alaska MileagePlan mile) and some extremely generous bonuses when they were in the process of acquiring Virgin America. This fare was a slightly more reasonable $4,787, but I still ended up with an 8 cents per point redemption which is far more than the 2 cents per point that most people value Alaska miles at.

Earning the Miles I Redeemed

Neither American Airlines nor Alaska Airlines are direct transfer partners of the two largest credit card point “currencies”, being American Express Membership Rewards Points and Chase Ultimate Rewards Points, but there is a path transfer points there in a pinch. Both Amex and Chase allow you to transfer their points to Marriott Bonvoy Points at a 1:1 ratio, and you can then transfer Marriott Points to AAdvantage Miles or MileagePlan Miles at a 3:1 ratio (plus 5,000 additional miles per 60,000 Marriott Points transferred). That transfer doesn’t make sense most days, but would have allowed me to secure these flights by utilizing sign up bonuses on some of my favorite travel cards rather than signing up for the airlines’ own cobrand cards, which are not nearly as flexible.

Note: if you happen to already have Chase Ultimate Rewards Points, there is currently a 50% transfer bonus to Marriott Bonvoy for a limited time, which would provide a much better value. That being said, I don’t recommend transferring to Marriott without a booking or airline transfer in mind as they devalue their points periodically, sometimes without notice.

If you want a stash of transferrable points to have in case a deal like this comes up, look no further than the Platinum Card from American Express. For a limited time, if you use my referral link here, you can earn a massive 150,000 Membership Rewards Points sign up bonus and $200 in statement credits just for spending $6,000 in the first six months of card membership. The Platinum Card does have a whopping $695 annual fee, but there are a host of benefits which help offset it completely, and I will happily coach you through maximizing them. If you want a solid card with a lower fee, simply click “View All Cards with a Referral Offer” and then “Personal Cards” and you will see elevated sign up offers on both the Amex Gold Card ($250 Annual Fee with up to $240 a year in Uber and Grubhub Credits plus 4X points per dollar at Restaurants and Grocery Stores) and Amex Green Card ($150 with a free Clear membership and 3X points per dollar earning on Dining and Travel), which are both fantastic travel cards which allow you to transfer points to various airlines or Marriott if your desired airline isn’t a direct transfer partner.

Another solid option with a lower annual fee is the Chase Sapphire Preferred Card from Chase. If you use my referral link, you can earn 60,000 Ultimate Rewards Points when you spend $4,000 in the first three months of card membership. This card has a more modest $95 annual fee and has a strong 3X points per dollar earning structure on Dining, Streaming, and Online Grocery Purchases (like Instacart).

I prefer more flexible travel cards like those mentioned above, but you can earn AAdvantage miles from co-branded American Airlines cards offered by both Citi and Barclays. Personally, I prefer the Barclays AAdvantage Aviator card due to the extremely easy bonus (50,000 AAdvantage miles with your first purchase and payment of the annual fee). For MileagePlan miles, you can sign up for the Bank of America Alaska Airlines Card, which is currently offering a 70,000 mile signup bonus once you spend $3,000 in the first three months of card membership. The downside of these cards is that they lock you into earning one particular type of mile, and airlines are notorious for stealth devaluations of miles. The earning structures on these cards also tend to be much less generous than those of the premium travel cards offered by American Express and Chase.

I will report back once I decide on a hotel in Tokyo, but please let me know if you have any questions. I am always happy to provide recommendations for the best credit card strategy given your unique financial situation and travel aspirations, and I will never charge you. I just ask that you use one of my referral links if one of the cards I recommend works for you.

Note: I earn a referral bonus when you use some of the links in this article. Generally, my referral links offer you a better sign up bonus than what is publicly available. In the event that I know of a better public offer, I will share it with you as well so you can decide which you’d like to apply with. You won’t hurt my feelings, I promise!